Companies angling to take advantage of new tax credits in the Inflation Reduction Act for making clean hydrogen are asking lots of questions.

Some of the questions will have to await guidance from the US Treasury.

The Treasury is expected to ask imminently for comments on the new hydrogen credits as a precursor to writing guidance.

A “clean hydrogen production standard” that the US Department of Energy proposed in early October answered at least one of the questions.

Two Options

The IRA gives anyone producing “clean hydrogen” the choice of production tax credits of up to $3 a kilogram for 10 years on the hydrogen produced or an investment tax credit of up to 30% of the cost of the electrolyzer and other equipment.

The investment tax credit is claimed entirely in the year the electrolyzer or other equipment is put in service. The hydrogen producer must choose between the two credits. It cannot claim both.

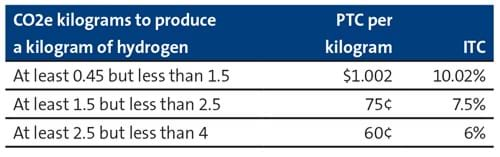

The credit amounts vary depending on the greenhouse gases emitted to produce a kilogram of hydrogen. The greenhouse gases are converted into CO2-equivalent emissions.

To claim credits at the full rate, the production process must lead to less than 0.45 kilograms of CO2-equivalent emissions per kilogram of hydrogen.

The following table shows the tax credit amounts where the CO2-equivalent emissions exceed that amount.

No credits can be claimed on hydrogen produced with more than four kilograms of CO2 emissions per kilogram of hydrogen.

The CO2 emissions are measured on a lifecycle basis, meaning taking into account all of the emissions from feedstock through the point the hydrogen is produced (rather than also through consumer use). Hydrogen producers can petition the IRS to determine their lifecycle emissions rates.

The production tax credit amount will be adjusted annually for inflation using 2022 as the base year for measuring inflation.

Production tax credits can only be claimed on hydrogen produced in 2023 or later.

The hydrogen must be produced for sale or use as hydrogen, and the quantity sold or used must be verified by a third party.

The hydrogen must be produced in the United States or a US possession like Puerto Rico.

Production tax credits cannot be claimed on hydrogen produced at a facility that is owned by one company and used by another company. An example is where company A owns a plant and leases it to company B to be used to make hydrogen. The owner and user must be the same company for tax purposes. This is not a barrier to claiming an investment tax credit.

Hydrogen PTCs may be claimed for 10 years starting on the date the facility is originally placed in service. Thus, a facility put in service before 2023 will have used up part of the 10-year period by the time it is able to start claiming tax credits. However, a facility that was not producing clean hydrogen before 2023 and that is modified in 2023 or later to produce such hydrogen can treat the 10 years as starting when the improvements are placed in service.

Hydrogen producers will have the option to be paid the cash value of production tax credits — but not the investment tax credit, if that option is selected — under an IRS refund process, but only for the first five tax years of credits commencing with the tax year the producer places the hydrogen plant in service. The five-year period cannot stretch beyond 2032. Tax credits after the refund period ends can be sold to other companies for cash (as can investment tax credits). (For more details on transferring tax credits, see “Searching for Opportunities in the Inflation Reduction Act” in the August 2022 NewsWire.)

An investment tax credit cannot be claimed on a hydrogen plant put in service before 2023 or on tax basis built up before 2023 where the plant was already under development or construction before 2023.

However, it appears that one benefit of claiming an investment credit is the ability to claim bonus credits for hydrogen plants in “energy communities” or that use domestic content that could increase the hydrogen ITC to as high as 50%. (For more details, see “Searching for Opportunities in the Inflation Reduction Act” in the August 2022 NewsWire.)

Projects must be under construction by the end of 2032 to qualify for hydrogen tax credits.

The tax credits will be only a fifth of the full rate unless mechanics and laborers working on the project are paid at least “prevailing wages” as determined by the US Department of Labor and qualified apprentices are used for at least 10% (increasing to 15%) of total labor hours, both during construction and when making any repairs or alterations during the full period production tax credits are claimed or, where an investment tax credit is claimed, during the five-year period the ITC is subject to recapture. Apprentices are supposed to be used to train more workers for jobs in the green economy. (For more details, see “Wage and Apprentice Requirements” in the October 2022 NewsWire.)

The IRA allows owners of wind, solar and other renewable energy and nuclear power plants to use the electricity they generate in 2023 or later to make clean hydrogen and still claim separate PTCs on the electricity output, thus doubling up on PTCs for generating wind, solar, geothermal or nuclear electricity and then using the electricity to make green hydrogen. Normally, PTCs can only be claimed if the electricity is sold to an unrelated person.

However, care must be taken not to lose depreciation on the power plant. Tax losses cannot be claimed on property sold to an affiliate. Electricity is considered property for this purpose. Many renewable energy power plants have tax losses for the first three years on account of front-loaded depreciation. (For more details, see “Section 707(b): Related-Party Electricity Sales” in the June 2021 NewsWire and “Utility Tax Equity Partnerships” in the August 2021 NewsWire.)

Common Questions

Companies planning to make clean hydrogen are asking a number of questions.

One is whether tax credits can be “stacked,” for example by claiming hydrogen PTCs or a hydrogen ITC, section 45Q credits for capturing the carbon emissions and section 45Z credits for making sustainable aviation or other clean transportation fuels. The answer is no if done at the same “facility.” The Treasury will have to address what happens if the hydrogen plant and the carbon capture or fuel production equipment are owned by different parties.

Another frequent question is whether projects can buy renewable energy credits or enter into virtual power purchase agreements with renewable energy projects to offset emissions from using grid electricity.

Senator Tom Carper (D-Delaware) asked Senator Ron Wyden (D-Oregon), the floor manager for the Inflation Reduction Act tax provisions, that question shortly before the Senate vote in August. Carper asked whether the intention is to allow hydrogen producers to use “indirect accounting factors” such as RECs, renewable thermal credits, renewable identification numbers (RINs) and biogas credits to reduce effective greenhouse gas emissions. Wyden said yes.

There are rumors that any such ability to claim RECs as offsets may be limited to renewable energy projects in the same geographic area, possibly by balancing authority. There are 66 separate balancing authorities in the US.

The US Department of Energy issued a proposed clean hydrogen production standard, called “CHPS,” for comment in October on which the IRS is likely to rely. One question the department asked is whether “renewable energy credits, power purchase agreements, or other market structures” should be taken into account as potential emissions offsets and, if so, whether there should be “restrictions on time of generation, time of use, or regional considerations.”

DOE said that CHPS is not a regulatory standard, but that it aligns with the hydrogen tax credits. The department has $8 billion in grant money to award to six to 10 hydrogen hubs. It said it may still select some projects that have higher emissions than the CHPS standard to qualify as clean hydrogen, but that still help reduce greenhouse gas emissions across the supply chain.

DOE gave two examples of where it thinks projects would fall on the emissions spectrum.

It said that it expects electrolysis systems can limit lifecycle emissions to approximately four kilograms of CO2 equivalent per kilogram of hydrogen produced by limiting grid electricity to about 15% of total power used. It said a steam methane reformer that uses all grid electricity, with average US emissions for such electricity, should be able to do so as well by capturing and sequestering 95% of its carbon emissions and limiting upstream methane emissions to 1%.

Hydrogen producers have been asking whether tax credits can be claimed where hydrogen is produced as an intermediate chemical in a step toward producing a different end product. The Treasury will have to decide in guidance. One issue is how this differs from the case where hydrogen is produced and then converted into ammonia for transport where tax credits can be claimed.

DOE suggested in its CHPS standard that hydrogen produced as a byproduct of another process may qualify as clean hydrogen — for example, in chlor-alkali production and petrochemical cracking — but asked what companies normally do with such hydrogen and how much of the greenhouse gas emissions associated with the larger process should be allocated to the hydrogen.

Another frequent question is whether emissions from using grid electricity to liquefy or compress hydrogen for transportation must be taken into account as part of the lifecycle emissions. DOE said no. It said its CHPS uses the same lifecycle emissions boundary as used for the hydrogen tax credits.

The boundary includes “upstream processes (e.g., electricity generation, fugitive emissions), as well as downstream processes associated with ensuring that CO2 produced is safely and durably sequestered.” Emissions associated with sequestration off site are taken into account. However, “other post-hydrogen production steps such as potential liquefaction, compression, dispensing into vehicles, etc.” are not taken into account, DOE said. It said more than 20 countries are working to harmonize how their calculations are done.

Some types of fuels can have negative emissions. This would be true of things like municipal garbage and animal waste that would otherwise have been disposed of in ways that produce large greenhouse gas emissions if not used for hydrogen production. DOE asked for help figuring out how to quantify the negative emissions.

It also asked how emissions should be allocated among hydrogen and other co-products that are produced at the same time, such as steam, electricity, elemental carbon and oxygen.

Comments

-

Danielvon

У нас можно найти стильные товары от известного бренда Gucci. Ассортимент включает одежду, , для самых изысканных покупателей.

https://boutique.gucci1.ru -

-

KelvinMor

У нас можно заказать обувь New Balance с отличным качеством. Выбирайте свою идеальную пару прямо сейчас.

https://top100bookmark.com/story18625880/new-balance-550 -

GeorgePring

Получите свежие цветы из Голландии в ваш город.

Мы выбираем только самые свежие и качественные цветы, для вашего вдохновения и удовольствия.

цветы доставить -

StevenCat

На этом сайте представлены качественные витамины для поддержания мозга. Они помогут стимуляции работы мозга.

https://holden6hk6r.imblogs.net/81912469/витамины-для-мозга-Обзор -

Dwightwrimi

На этом сайте вы сможете найти отличные витамины для мозга. Подберите подходящий вариант, который поможет активизации умственных способностей.

https://august2uo4z.alltdesign.com/Факты-о-витамины-для-мозга-Показали-51599281 -

Williamrip

На этом ресурсе вы можете ознакомиться с важной информацией о лечении депрессии у людей старшего возраста. Здесь собраны советы и обзоры способов борьбы с данным состоянием.

http://www.dadijanki.org/wp/?p=3737&unapproved=2510505&moderation-hash=1731db90837996d6aeae20967742d5d2 -

Rolandtiz

На этом сайте вы найдёте подробную информацию о терапии депрессии у людей преклонного возраста. Вы также узнаете здесь о профилактических мерах, современных подходах и советах экспертов.

http://www.einjahrsommer.com/wp/?page_id=245&cpage=8039 -

Rolandtiz

На этом сайте вы сможете найти подробную информацию о терапии депрессии у пожилых людей. Вы также узнаете здесь о методах профилактики, современных подходах и рекомендациях специалистов.

https://mydnepr.pp.ua/forum/topic.php?forum=14&topic=249 -

RonaldTwime

На данном сайте вы сможете узнать полезную информацию о полезных веществах для улучшения работы мозга. Также здесь представлены советы экспертов по выбору подходящих добавок и их влиянию на когнитивных функций.

https://garrett4sc4i.blogolize.com/Объективное-Вид-витамины-для-мозга-71301759 -

TimothyZem

На данном сайте вы сможете найти подробную информацию о терапии депрессии у пожилых людей. Вы также узнаете здесь о профилактических мерах, современных подходах и советах экспертов.

http://www.linanoory.com/2019/03/28/whats-in-my-bag-lip-filler-experience/ -

ScottGah

На этом сайте вы сможете узнать подробную информацию о витаминах для улучшения работы мозга. Кроме того, вы найдёте здесь рекомендации специалистов по выбору эффективных добавок и способах улучшения когнитивных функций.

https://martin9gi6o.blogthisbiz.com/38687276/Лучшая-сторона-витамины-для-мозга -

BennyJop

На данном сайте вы сможете найти подробную информацию о терапии депрессии у людей преклонного возраста. Также здесь представлены методах профилактики, современных подходах и советах экспертов.

http://edtechipedia.org/index.php?title=%D0%94%D0%B5%D0%BF%D1%80%D0%B5%D1%81%D1%81%D0%B8%D1%8F%20%D0%BF%D0%BE%D1%81%D0%BB%D0%B5%2070 -

BennyJop

На этом сайте вы сможете найти подробную информацию о препарате Ципралекс. Вы узнаете здесь сведения о основных показаниях, режиме приёма и вероятных побочных эффектах.

http://SurglaIndia.eorg.site/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1 -

BennyJop

На данном сайте можно ознакомиться с информацией о решениях видеонаблюдения, разновидностях и особенностях. Здесь представлены полезные сведения о выборе оборудования, монтаже и настройке.

видеонаблюдение -

Stephensaf

На этом сайте можно найти информацией о системах видеонаблюдения, их видах и особенностях. Здесь представлены подробные сведения о подборе оборудования, его установке и настройке.

видеонаблюдение -

BennyJop

На этом сайте вы сможете найти полезную информацию о лекарственном средстве Ципралекс. Здесь представлены сведения о показаниях, дозировке и возможных побочных эффектах.

http://KornukbanisiTurkey.auio.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1 -

BennyJop

На этом сайте вы найдёте подробную информацию о лекарственном средстве Ципралекс. Здесь представлены сведения о основных показаниях, дозировке и возможных побочных эффектах.

http://InterCityHotelNuernbergGermany.eorg.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1 -

JamesPlase

На данном сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, его сюжете и главных персонажах. однажды в сказке онлайн/a> Здесь представлены подробные материалы о производстве шоу, исполнителях ролей и любопытных деталях из-за кулис.

-

BennyJop

На данном сайте вы найдёте подробную информацию о лекарственном средстве Ципралекс. Вы узнаете здесь сведения о основных показаниях, дозировке и вероятных побочных эффектах.

http://NovoYablonovskiyRussianFederation.jocc.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1 -

DanielKet

На этом сайте вы найдёте полезную информацию о лекарственном средстве Ципралекс. Здесь представлены информация о основных показаниях, дозировке и вероятных побочных эффектах.

http://NukuReefFiji.auio.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1 -

RobertAlems

This CCTV software delivers a powerful video surveillance solution, featuring intelligent detection capabilities for humans, felines, avians, and canines. As a versatile surveillance camera software, it acts as an IP camera recorder and supports time-lapse recording. The best Video Surveillance Software Enjoy safe remote access to your IP camera feeds through a reliable cloud video surveillance platform. This video monitoring software strengthens your security system and is an ideal option for your CCTV monitoring needs.

-

Robertfab

На данном сайте можно найти актуальные промокоды ЦУМ https://tsum.egomoda.ru.

Применяйте данные купоны, чтобы получить скидки на покупки.

Предложения обновляются регулярно, так что не пропускайте новыми предложениями.

Экономьте на товары с лучшими промокодами для ЦУМа. -

Dannyguava

На этом сайте можно получить актуальное зеркало 1xBet.

Мы размещаем исключительно свежие адреса для доступа.

Когда главный портал недоступен, примените зеркалом.

Оставайтесь постоянно на связи без ограничений.

https://bundas24.com/read-blog/188807 -

Однажды в сказке

На данном сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, развитии событий и ключевых персонажах. однажды в сказке онлайн Здесь размещены подробные материалы о производстве шоу, исполнителях ролей и фактах из-за кулис.

-

coach-bag-shop.ru

На представленном сайте можно купить оригинальные сумки Coach https://coach-bag-shop.ru/.

В ассортименте представлены разнообразные модели для любых случаев.

Каждая сумка сочетает в дизайне премиальность и утонченность.

Оформите заказ сейчас и получите быструю пересылку в кратчайшие сроки! -

MixWatch

На данном сайте MixWatch можно найти актуальные новости о мире часов.

Здесь публикуются обзоры новых моделей и разборы известных марок.

Ознакомьтесь с экспертными мнениями по трендам в часовом мире.

Будьте в курсе ключевыми событиями индустрии!

https://mixwatch.ru/ -

Однажды в сказке

На этом сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, развитии событий и ключевых персонажах. смотреть однажды в сказке хорошем качестве Здесь представлены интересные материалы о создании шоу, исполнителях ролей и фактах из-за кулис.

-

Dennisnet

Программа видеонаблюдения – это актуальное решение для обеспечения безопасности , объединяющий технологии и удобство использования .

На веб-ресурсе вы найдете подробное руководство по настройке и установке систем видеонаблюдения, включая облачные решения , их преимущества и ограничения .

Видеонаблюдение для земельных участков

Рассматриваются гибридные модели , сочетающие облачное и локальное хранилище , что делает систему более гибкой и надежной .

Важной частью является описание передовых аналитических функций , таких как детекция движения , распознавание объектов и дополнительные алгоритмы искусственного интеллекта. -

Dennisnet

Программа видеонаблюдения – это актуальное решение для обеспечения безопасности , объединяющий технологии и удобство использования .

На сайте вы найдете детальные инструкции по настройке и установке систем видеонаблюдения, включая онлайн-хранилища, их сильные и слабые стороны.

Программы для видеонаблюдения

Рассматриваются гибридные модели , объединяющие локальное и удаленное хранение, что делает систему более гибкой и надежной .

Важной частью является описание передовых аналитических функций , таких как определение активности, распознавание объектов и другие AI-технологии . -

Однажды в сказке

На этом сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, его сюжете и ключевых персонажах. смотреть однажды в сказке Здесь размещены интересные материалы о производстве шоу, актерах и фактах из-за кулис.

-

Robertvah

Промокоды — это уникальные комбинации символов, дающие выгоду при покупках.

Они применяются в интернет-магазинах для получения бонусов.

http://sportandpolitics.ukrbb.net/viewtopic.php?f=24&t=20801

На этом сайте вы сможете получить актуальные промокоды разных брендов.

Применяйте их, чтобы сократить расходы на покупки. -

DonnyBof

This comprehensive resource serves as an comprehensive guide to the realm of modern video surveillance, offering valuable insights for both skilled CCTV installers and entrepreneurs seeking to improve their security infrastructure.

Video Surveillance

The site presents a detailed analysis of online video surveillance systems, examining their strengths, limitations, and practical applications. -

Однажды в сказке

На этом сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, развитии событий и главных персонажах. https://odnazhdy-v-skazke-online.ru/ Здесь размещены интересные материалы о создании шоу, исполнителях ролей и фактах из-за кулис.

-

JamesWhent

Здесь доступны актуальные события России и мира .

Здесь можно прочитать важные новостные материалы на различные темы.

https://ecopies.rftimes.ru/

Читайте главных событий ежедневно .

Объективность и скорость подачи в каждом материале . -

1win-casino-ng.com

On this website, you will find details about the 1Win gambling platform in Nigeria.

It covers key features, such as the well-known online game Aviator.

https://1win-casino-ng.com/

You can also discover betting options.

Enjoy an exciting gaming experience! -

e-copies.ru

Этот сайт — востребованное цифровое медиа.

Мы оперативно представляем ключевые новости.

https://rftimes.ru/html/smi.html

Редакция портала работает над тем, чтобы предоставлять только проверенную информацию.

Оставайтесь с нами, чтобы не пропустить свежие публикации! -

RobertPiort

Здесь вы можете заказать увеличение отметок «Нравится» и подписчиков в соцсетях, включая ВК, TikTok, Telegram и прочие.

Быстрая и безопасная накрутка профиля гарантирована .

Как накрутить реакции в Телеграм на пост

Выгодные тарифы и качественное выполнение .

Начните рост популярности прямо сейчас! -

Robertadurl

На данном сайте вы можете приобрести онлайн телефонные номера разных операторов. Они могут использоваться для регистрации аккаунтов в различных сервисах и приложениях.

В каталоге представлены как долговременные, так и одноразовые номера, что можно использовать для получения сообщений. Это простое решение для тех, кто не хочет указывать личный номер в сети.

купить номер для ватсап

Оформление заказа максимально удобный: определяетесь с необходимый номер, оплачиваете, и он будет готов к использованию. Оцените сервис уже сегодня! -

Robertadurl

На данном сайте у вас есть возможность приобрести виртуальные телефонные номера различных операторов. Эти номера могут использоваться для регистрации профилей в разных сервисах и приложениях.

В ассортименте доступны как долговременные, так и одноразовые номера, которые можно использовать для получения SMS. Это удобное решение если вам не желает указывать личный номер в интернете.

купить номер телефона 8800

Процесс покупки максимально удобный: определяетесь с подходящий номер, оплачиваете, и он будет доступен. Попробуйте услугу уже сегодня! -

Robertadurl

На данном сайте у вас есть возможность приобрести виртуальные мобильные номера различных операторов. Эти номера могут использоваться для регистрации аккаунтов в разных сервисах и приложениях.

В ассортименте представлены как постоянные, так и временные номера, что можно использовать для получения SMS. Это удобное решение для тех, кто не желает указывать личный номер в интернете.

віртуальний номер для смс

Оформление заказа очень простой: определяетесь с необходимый номер, оплачиваете, и он сразу становится готов к использованию. Оцените сервис уже сегодня! -

KennyVeins

This Video Surveillance Software has exceeded my expectations in every way. The AI-powered object detection is incredibly accurate, and the fact that it’s available for free is a huge plus. The software supports both mobile and desktop platforms, making it versatile and convenient. The advanced detection capabilities for people, pets, and even birds are a standout feature. If you’re looking for a reliable and feature-rich security solution, this is it. The time-lapse recording and IP camera recorder functionalities are just the icing on the cake.

-

Robertadurl

На этом сайте вы можете приобрести виртуальные мобильные номера разных операторов. Они могут использоваться для подтверждения аккаунтов в различных сервисах и приложениях.

В ассортименте представлены как долговременные, так и временные номера, что можно использовать для получения SMS. Это простое решение если вам не хочет указывать основной номер в интернете.

виртуальный номер для смс

Оформление заказа очень простой: определяетесь с подходящий номер, оплачиваете, и он сразу становится доступен. Попробуйте сервис прямо сейчас! -

-

Danielemips

На этом сайте представлена полезная информация о лечении депрессии, в том числе у возрастных пациентов.

Здесь можно найти методы диагностики и советы по восстановлению.

http://americancorner.org/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Falimemazin-primenenie-pobochnye-effekty-otzyvy%2F

Особое внимание уделяется психологическим особенностям и их влиянию на психическим здоровьем.

Также рассматриваются эффективные терапевтические и психологические методы лечения.

Материалы помогут лучше понять, как правильно подходить к угнетенным состоянием в пожилом возрасте. -

Danielemips

На этом сайте представлена полезная информация о лечении депрессии, в том числе у пожилых людей.

Здесь можно найти способы диагностики и подходы по улучшению состояния.

http://amstelbrightbonaire.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Felitseya-i-elitseya-ku-tab-preimushchestva%2F

Особое внимание уделяется психологическим особенностям и их связи с психическим здоровьем.

Также рассматриваются эффективные медикаментозные и немедикаментозные методы лечения.

Статьи помогут лучше понять, как правильно подходить к депрессией в пожилом возрасте. -

Danielemips

На этом сайте представлена полезная информация о терапии депрессии, в том числе у возрастных пациентов.

Здесь можно узнать методы диагностики и советы по восстановлению.

http://carnago.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Folanzapin-i-bar%2F

Особое внимание уделяется возрастным изменениям и их связи с психическим здоровьем.

Также рассматриваются современные медикаментозные и немедикаментозные методы поддержки.

Статьи помогут разобраться, как справляться с депрессией в пожилом возрасте. -

Danielemips

На этом сайте представлена полезная информация о лечении депрессии, в том числе у возрастных пациентов.

Здесь можно найти методы диагностики и подходы по восстановлению.

http://affiniamanhattannyc.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Ftrevozhnye-rasstroystva-u-zhenshchin%2F

Особое внимание уделяется психологическим особенностям и их влиянию на эмоциональным состоянием.

Также рассматриваются эффективные медикаментозные и психологические методы поддержки.

Материалы помогут лучше понять, как правильно подходить к угнетенным состоянием в пожилом возрасте. -

RobertReugh

На этом сайте вы можете купить оценки и подписчиков для Instagram. Это поможет увеличить вашу известность и привлечь новую аудиторию. Мы предлагаем моментальное добавление и гарантированное качество. Выбирайте подходящий тариф и продвигайте свой аккаунт без лишних усилий.

Накрутка подписчиков Инстаграм купить дешево -

-

-

RobertReugh

На данном сайте АвиаЛавка (AviaLavka) вы можете забронировать выгодные авиабилеты по всему миру.

Мы предлагаем лучшие цены от надежных авиакомпаний.

Простой интерфейс позволит быстро найти подходящий рейс.

https://www.avialavka.ru

Интеллектуальный фильтр помогает выбрать оптимальные варианты перелетов.

Покупайте билеты онлайн без скрытых комиссий.

АвиаЛавка — ваш надежный помощник в поиске авиабилетов! -

www.avialavka.ru

На этом сайте АвиаЛавка (AviaLavka) вы можете купить дешевые авиабилеты в любые направления.

Мы подбираем лучшие тарифы от надежных авиакомпаний.

Удобный интерфейс позволит быстро подобрать подходящий рейс.

https://www.avialavka.ru

Интеллектуальный фильтр помогает выбрать самые дешевые варианты перелетов.

Бронируйте билеты онлайн без переплат.

АвиаЛавка — ваш удобный помощник в путешествиях! -

RobertReugh

На этом сайте вы можете купить аудиторию и лайки для TikTok. Мы предлагаем активные аккаунты, которые способствуют продвижению вашего профиля. Быстрая накрутка и стабильный прирост обеспечат увеличение вашей активности. Цены доступные, а процесс заказа занимает минимум времени. Запустите продвижение уже сегодня и станьте популярнее!

Накрутка просмотров Тик Ток онлайн бесплатно -

DavidCoura

Здесь можно узнать методы диагностики и советы по восстановлению.

http://chemoyossi.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Fistericheskoe-rasstroystvo-lichnosti%2F

Отдельный раздел уделяется возрастным изменениям и их влиянию на психическим здоровьем.

Также рассматриваются эффективные терапевтические и немедикаментозные методы поддержки.

Материалы помогут лучше понять, как правильно подходить к депрессией в пожилом возрасте. -

Matthewmub

Эта платформа помогает накрутить видеопросмотры и зрителей в Twitch. Благодаря нашим услугам ваш канал получит больше охвата и заинтересует новых зрителей. Сколько стоит накрутка зрителей на Твиче Мы гарантируем реальные просмотры и заинтересованных пользователей, что улучшит статистику трансляции. Быстрая работа и доступные тарифы позволяют развивать канал максимально эффективно. Простое оформление заказа занимает всего пару минут. Начните раскрутку уже прямо сейчас и выведите свой Twitch-канал на новый уровень!

-

RobertReugh

На данном сайте вы можете заказать подписчиков и лайки для Telegram. Мы предлагаем качественные аккаунты, которые помогут росту вашего канала. Оперативная накрутка и гарантированный результат обеспечат успешное продвижение. Цены выгодные, а процесс заказа прост. Начните продвижение уже сейчас и увеличьте активность в своем Telegram!

Накрутить подписчиков в Телеграмм канал бесплатно живых -

Michaelvek

На этом сайте вы можете купить лайки и фолловеров для Instagram. Это позволит увеличить вашу известность и заинтересовать новую аудиторию. Здесь доступны моментальное добавление и гарантированное качество. Оформляйте подходящий тариф и продвигайте свой аккаунт легко и просто.

Накрутка Инстаграм бесплатно онлайн -

AaronBleah

Я думал, что потерял свои биткоины, но специальный сервис помог мне их восстановить.

Изначально я сомневался, что что-то получится, но удобный алгоритм удивил меня.

Используя уникальному подходу, платформа нашла утерянные данные.

Всего за несколько шагов я удалось вернуть свои BTC.

Этот сервис действительно работает, и я советую его тем, кто утратил доступ к своим криптоактивам.

https://www.pentaxfriends.eu/viewtopic.php?f=67&t=8446 -

Michaelvek

На этом сайте вы можете заказать аудиторию для Telegram. Мы предлагаем качественные аккаунты, которые помогут развитию вашего канала. Оперативная доставка и стабильный прирост обеспечат надежный рост подписчиков. Цены доступные, а процесс заказа не требует лишних действий. Запустите продвижение уже сейчас и нарастите аудиторию своего канала!

Накрутка подписчиков в Телеграм живые без обмана -

RobertReugh

На этом сайте вы можете купить аудиторию и лайки для TikTok. Мы предлагаем активные аккаунты, которые помогут продвижению вашего профиля. Быстрая накрутка и стабильный прирост обеспечат рост вашей активности. Тарифы доступные, а оформление заказа занимает минимум времени. Начните продвижение уже сегодня и станьте популярнее!

Накрутка просмотров Тик Ток без регистрации -

AaronBleah

Я боялся, что потерял свои биткоины, но этот инструмент помог мне их восстановить.

Сначала я сомневался, что что-то получится, но удобный алгоритм оказался эффективным.

Благодаря специальным технологиям, платформа нашла доступ к кошельку.

Всего за несколько шагов я удалось восстановить свои BTC.

Этот сервис действительно работает, и я рекомендую его тем, кто потерял доступ к своим криптоактивам.

https://www.akademiahomeopatie.sk/forum/viewtopic.php?f=49&t=107375 -

RobertReugh

Наша компания помогает накрутить охваты и подписчиков во ВКонтакте. Мы предлагаем эффективное продвижение, которое способствует увеличению активности вашей страницы или группы. Накрутка просмотров клипов ВК Аудитория активные, а просмотры накручиваются оперативно. Доступные цены позволяют подобрать оптимальный вариант для разного бюджета. Оформление услуги максимально прост, а результат не заставит себя ждать. Начните продвижение прямо сейчас и сделайте свой профиль заметнее!

-

LarryCox

На данном сайте вы найдете полезные сведения о ментальном здоровье и его поддержке.

Мы рассказываем о способах развития эмоционального благополучия и снижения тревожности.

Полезные статьи и рекомендации специалистов помогут разобраться, как сохранить психологическую стабильность.

Важные темы раскрыты доступным языком, чтобы любой мог найти важную информацию.

Позаботьтесь о своем ментальном состоянии уже прямо сейчас!

http://centerpointenergyintellisave.us/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fa%2Famitriptilin%2F -

Michaelvek

На этом сайте вы у вас есть возможность купить оценки и фолловеров для Instagram. Это позволит увеличить вашу популярность и привлечь больше людей. Мы предлагаем быструю доставку и гарантированное качество. Выбирайте удобный пакет и продвигайте свой аккаунт без лишних усилий.

Накрутка лайков Инстаграми -

FrankTable

Центр ментального здоровья — это пространство, где любой может получить помощь и профессиональную консультацию.

Специалисты помогают разными запросами, включая стресс, эмоциональное выгорание и депрессивные состояния.

http://spinuzzi.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Fantidepressanty%2F

В центре используются эффективные методы лечения, направленные на восстановление эмоционального баланса.

Здесь создана комфортная атмосфера для доверительного диалога. Цель центра — помочь каждого обратившегося на пути к душевному равновесию. -

FrankTable

Центр ментального здоровья — это пространство, где каждый может найти поддержку и профессиональную консультацию.

Специалисты работают с разными запросами, включая стресс, усталость и депрессивные состояния.

ww17.hapylifeday.com

В центре применяются современные методы терапии, направленные на улучшение эмоционального баланса.

Здесь создана безопасная атмосфера для открытого общения. Цель центра — поддержать каждого обратившегося на пути к психологическому здоровью. -

LarryCox

На данном сайте вы найдете всю информацию о ментальном здоровье и его поддержке.

Мы рассказываем о методах развития эмоционального равновесия и снижения тревожности.

Полезные статьи и рекомендации специалистов помогут понять, как сохранить душевное равновесие.

Актуальные вопросы раскрыты доступным языком, чтобы любой мог получить важную информацию.

Начните заботиться о своем ментальном состоянии уже сегодня!

healthandsafetyguy.com -

Andrewvem

Клиника душевного благополучия — это пространство, где помогают о вашем психике.

В нем трудятся специалисты , стремящиеся помочь в сложные моменты.

Цель центра — восстановить эмоциональное равновесие клиентов.

Предлагаются консультации для решения проблем и трудностей.

Это место обеспечивает безопасную среду для исцеления .

Посещение центра — шаг к гармонии и внутреннему покою.

https://www.skillsmalaysia.gov.my/index.php/k2-full-width/item/75-magnam-aliquam-quaerat-voluptatem?start=30 -

PhillipLoace

Клиника душевного благополучия — это пространство, где заботятся о вашем разуме .

В нем трудятся специалисты , готовые поддержать в трудные времена .

Цель центра — восстановить эмоциональное равновесие клиентов.

Услуги включают консультации для решения проблем и трудностей.

Такой центр обеспечивает безопасную среду для развития.

Обращение сюда — шаг к гармонии и лучшей жизни .

rhinopm.com -

PhillipLoace

Клиника душевного благополучия — это место , где помогают о вашем психике.

В нем трудятся специалисты , готовые поддержать в трудные времена .

Цель центра — восстановить эмоциональное равновесие клиентов.

Услуги включают консультации для преодоления стресса и трудностей.

Такой центр создает комфортную атмосферу для исцеления .

Обращение сюда — шаг к гармонии и лучшей жизни .

mosreut.flybb.ru -

tlover tonet

There are some interesting cut-off dates in this article but I don’t know if I see all of them heart to heart. There’s some validity however I will take maintain opinion till I look into it further. Good article , thanks and we want more! Added to FeedBurner as properly

-

FrankTable

Центр “Эмпатия” оказывает комплексную поддержку в области ментального благополучия.

Здесь принимают квалифицированные психологи и психотерапевты, которые помогут с любыми трудностями.

В “Эмпатии” применяют современные методики терапии и индивидуальный подход.

Центр поддерживает при депрессии, панических атаках и сложностях.

Если вы ищете комфортное место для проработки личных вопросов, “Эмпатия” — верное решение.

wiki.letsbookmarktoday.com -

Benitovet

Центр ментального здоровья предлагает поддержку всем, кто нуждается психологическую помощь.

Наши психологи работают с различными проблемами: от стресса до эмоционального выгорания.

Мы применяем современные методы терапии, чтобы улучшить ментальное здоровье пациентов.

В уютной атмосфере нашего центра любой получит поддержку и заботу.

Записаться на консультацию можно по телефону в подходящий момент.

wiki.technomondo.xyz -

Williammal

Сегодня модный имидж имеет большое значение. Ваш образ влияет на восприятие окружающими, что напрямую влияет на успехе в карьере. Модный образ помогает чувствовать себя уверенно. Гармоничный стиль — это сочетание трендов и вашей уникальности. Работа над имиджем — это залог успеха.

https://idvendors.com/showthread.php?tid=1096&pid=6518#pid6518 -

Bryanshunc

Immerse yourself in the world of cutting-edge technology with the global version of the POCO M6 Pro, which combines advanced features, stylish design, and an affordable price. This smartphone is designed for those who value speed, quality, and reliability.

Why is the POCO M6 Pro your ideal choice?

– Powerful Processor: The octa-core Helio G99-Ultra delivers lightning-fast performance. Gaming, streaming, multitasking—everything runs smoothly and without lag.

– Stunning Display: The 6.67-inch AMOLED screen with FHD+ resolution (2400×1080) and a 120Hz refresh rate offers incredibly sharp and vibrant visuals. With a touch sampling rate of 2160 Hz, every touch is ultra-responsive.

– More Memory, More Possibilities: Choose between the 8/256 GB or 12/512 GB configurations to store all your files, photos, videos, and apps without compromise.

– Professional Camera: The 64 MP main camera with optical image stabilization (OIS), along with additional 8 MP and 2 MP modules, allows you to capture stunning photos in any conditions. The 16 MP front camera is perfect for selfies and video calls.

– Long Battery Life, Fast Charging: The 5000 mAh battery ensures all-day usage, while the powerful 67W turbo charging brings your device back to life in just a few minutes.

– Global Version: Support for multiple languages, Google Play, and all necessary network standards (4G/3G/2G) makes this smartphone universal for use anywhere in the world.

– Convenience and Security: The built-in fingerprint sensor and AI-powered face unlock provide quick and reliable access to your device.

– Additional Features: NFC, IR blaster, dual speakers, and IP54 splash resistance—everything you need for a comfortable experience.

The POCO M6 Pro is not just a smartphone; it’s your reliable companion in the world of technology.

Hurry and grab it at a special price of just 15,000 rubles! Treat yourself to a device that impresses with its power, style, and functionality.

Take a step into the future today—purchase it on AliExpress!

-

сертификация товаров

Процесс сертификации товаров играет ключевую роль для подтверждения соответствия стандартам. Она помогает создаёт положительную репутацию компании. Сертифицированная продукция часто является обязательным условием для сотрудничества с крупными партнёрами. К тому же, сертификация снижает риски. Важно помнить, что сертификация может быть обязательной или добровольной.

сертификация качества -

JasonMinna

Частная клиника предлагает всестороннюю медицинскую помощь для всей семьи.

Опытные врачи имеют многолетний опыт и используют современное оборудование.

Мы обеспечиваем все удобства для восстановления здоровья.

Мы предлагаем персонализированные медицинские решения для всех обратившихся.

Особое внимание мы уделяем профилактике заболеваний.

Наши пациенты могут получить качественное лечение по доступным ценам.

wiki.multiflay.com -

JamesLauff

This online pharmacy offers an extensive variety of pharmaceuticals at affordable prices.

You can find all types of medicines suitable for different health conditions.

Our goal is to keep high-quality products without breaking the bank.

Quick and dependable delivery guarantees that your medication gets to you quickly.

Experience the convenience of getting your meds with us.

https://www.lexpress.fr/economie/high-tech/comment-internet-veut-prendre-en-main-votre-sante_1403752.html -

DavidCen

В крупном городе доставка еды стала неотъемлемой частью повседневной жизни. Многие жители мегаполиса ценят удобство, которое она предоставляет, позволяя освободить время. Сейчас доставка еды — это не только способ быстро перекусить, но и ключевая составляющая в жизни busy людей. Множество сервисов предлагают разнообразие блюд, что делает этот сервис особенно актуальным для людей, ценящих комфорт и вкус. Без доставки еды сложно представить жизнь в мегаполисе, где каждый день приносит новые задачи и вызовы.

https://uyghuryol.com/forum/viewtopic.php?f=7&t=281292 -

Benitovet

Наша частная клиника предлагает высококачественные медицинские услуги в любых возрастных категориях.

Наши специалисты персонализированное лечение и заботу о вашем здоровье.

Команда профессионалов в нашей клинике опытные и внимательные врачи, работающие с современным оборудованием.

Мы предлагаем широкий спектр медицинских процедур, в числе которых консультации специалистов.

Ваш комфорт и безопасность — важнейшая задача нашего коллектива.

Запишитесь на прием, и мы поможем вам вернуться к здоровой жизни.

https://multipurpose-wapuula.com/userinfo.php?mod=space&user=anh.koonce-402423&from=space&com=profile -

сертификация товаров

На территории Российской Федерации сертификация имеет большое значение в обеспечении качества и безопасности товаров и услуг. Прохождение сертификации нужно как для бизнеса, так и для конечных пользователей. Наличие сертификата подтверждает, что продукция прошла все необходимые проверки. Особенно это актуально для товаров, влияющих на здоровье и безопасность. Прошедшие сертификацию компании чаще выбираются потребителями. Также это часто является обязательным условием для выхода на рынок. В итоге, сертификация способствует развитию бизнеса и укреплению позиций на рынке.

добровольная сертификация -

JamesLauff

Our e-pharmacy offers an extensive variety of pharmaceuticals for budget-friendly costs.

Shoppers will encounter all types of drugs suitable for different health conditions.

We work hard to offer trusted brands at a reasonable cost.

Fast and reliable shipping provides that your order gets to you quickly.

Experience the convenience of getting your meds on our platform.

https://music.amazon.com/podcasts/ae93133f-4e09-41c2-9c55-8d7f4a58767f/episodes/374132ca-96ea-4250-8b05-7f51be96f378/kamagra-jelly-a-new-frontier-in-male-health-kamagra-jelly-a-flavorful-approach-to-men's-wellness -

JasonMinna

Частная клиника предоставляет широкий спектр медицинских услуг для взрослых и детей.

Опытные врачи имеют многолетний опыт и работают на новейшей аппаратуре.

В клинике созданы все удобства для диагностики и лечения.

Клиника предоставляет индивидуальный подход для людей с различными потребностями.

Мы заботимся о профилактике заболеваний.

Наши пациенты могут рассчитывать на внимательное отношение без очередей и лишнего стресса.

wiki.buildwallpro.comprofile.php -

JamesLauff

The digital drugstore offers a broad selection of health products at affordable prices.

You can find various medicines for all health requirements.

We work hard to offer high-quality products without breaking the bank.

Quick and dependable delivery ensures that your medication gets to you quickly.

Enjoy the ease of ordering medications online with us.

https://uberant.com/article/2076163-valtrex-and-immune-health-supporting-your-body-during-viral-infections/ -

JamesSeR

Clothing trends in 2025 will bring a blend of contemporary designs and classic touches. Bold shades and unique pairings will take over. Sustainable materials will be a major focus, with designers offering an increasing number of upcycled fabrics. Relaxed-fit silhouettes and structured outfits will remain in demand. Futuristic features, such as wearable tech, will be incorporated into everyday apparel.

http://skax.de/guestbook/guestbook.php258 -

JamesLauff

This online pharmacy features a broad selection of health products at affordable prices.

You can find various medicines for all health requirements.

Our goal is to keep safe and effective medications while saving you money.

Speedy and secure shipping ensures that your order gets to you quickly.

Enjoy the ease of shopping online with us.

https://music.amazon.com/podcasts/5ab0d596-a35a-404a-8ed6-09ad1cf22464/episodes/21b1460f-7d28-42bb-8542-140a25b721ab/the-comprehensive-story-of-cenforce-100mg-cenforce-100mg-a-beacon-of-pharmaceutical-innovation -

JasonMinna

Современная клиника предлагает профессиональные медицинские услуги для всей семьи.

Команда профессионалов имеют многолетний опыт и используют современное оборудование.

У нас есть комфортные условия для прохождения обследований.

В нашем центре доступны гибкие программы лечения для людей с различными потребностями.

Особое внимание мы уделяем поддержанию высокого уровня сервиса.

Наши пациенты могут рассчитывать на оперативную помощь в удобное время.

exchange.fabchannel.xyz -

сертификация качества

В России сертификация имеет большое значение в обеспечении качества и безопасности товаров и услуг. Она необходима как для бизнеса, так и для конечных пользователей. Наличие сертификата подтверждает, что продукция прошла все необходимые проверки. Это особенно важно для товаров, влияющих на здоровье и безопасность. Прошедшие сертификацию компании чаще выбираются потребителями. Кроме того, это часто является обязательным условием для выхода на рынок. Таким образом, сертификация способствует развитию бизнеса и укреплению позиций на рынке.

сертификация качества продукции -

JamesOptib

Онлайн-игры сейчас очень популярны. Объём игроков увеличивается каждый год. Актуальные проекты предоставляют неповторимые механики, чем заманивают целую армию игроков глобально. Соревновательный гейминг вырос в перспективное направление. Крупные компании вкладывают колоссальные ресурсы в игровой бизнес.

http://forum.spolokmedikovke.sk/viewtopic.php?f=3&t=150789&p=910127#p910127 -

Cloud Video Surveillance

This site serves as a guide to desktop Video Surveillance Software, highlighting free IP camera monitoring tools and reviewing various surveillance solutions. It discusses advancements in AI-driven security systems, particularly free object detection features. The platform provides in-depth reviews of mobile and desktop applications, focusing on their usability and features. The showcased software delivers a sophisticated monitoring system with advanced detection for humans and animals. As an IP camera recorder, it includes time-lapse functionality and enhances security infrastructure, making it a solid choice for CCTV monitoring and VMS users.

-

Danielraf

У нас вы можете найти последние тренды из мира fashion-индустрии.

Следите за топовыми тенденциями, изучайте аналитику экспертов.

Публикуем о последних релизах брендов.

Здесь есть всё о модных показах из Парижа, Милана, Нью-Йорка и других столиц.

Исследуйте захватывающие интервью о влиятельных персоналиях индустрии.

Станьте в тренде благодаря нашему ресурсу.

http://beemoovkaarti.foorumi.eu/viewtopic.php?f=39&t=1437139 -

сертификация качества

В России сертификация играет важную роль для подтверждения соответствия продукции установленным стандартам. Прохождение сертификации нужно как для производителей, так и для потребителей. Наличие сертификата подтверждает, что продукция прошла все необходимые проверки. Это особенно важно в таких отраслях, как пищевая промышленность, строительство и медицина. Сертификация помогает повысить доверие к бренду. Также это часто является обязательным условием для выхода на рынок. Таким образом, сертификация способствует развитию бизнеса и укреплению позиций на рынке.

оформление сертификатов -

Benitovet

На этом сайте вы найдете клинику психологического здоровья, которая предоставляет профессиональную помощь для людей, страдающих от тревоги и других психологических расстройств. Мы предлагаем индивидуальный подход для восстановления психического здоровья. Наши опытные психологи готовы помочь вам преодолеть проблемы и вернуться к гармонии. Опыт наших специалистов подтверждена множеством положительных обратной связи. Запишитесь с нами уже сегодня, чтобы начать путь к восстановлению.

http://cpnoc.co/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Ff%2Ffenibut%2F -

сертификация качества продукции

В России сертификация имеет большое значение в обеспечении качества и безопасности товаров и услуг. Она необходима как для бизнеса, так и для конечных пользователей. Наличие сертификата подтверждает, что продукция прошла все необходимые проверки. Это особенно важно для товаров, влияющих на здоровье и безопасность. Сертификация помогает повысить доверие к бренду. Кроме того, это часто является обязательным условием для выхода на рынок. Таким образом, сертификация способствует развитию бизнеса и укреплению позиций на рынке.

обязательная сертификация -

Harryemoth

Здесь вы можете найти самые актуальные события из мира автомобилей.

Информация обновляется регулярно, чтобы вы быть в курсе всех значимых событий.

Автоновости охватывают разные стороны автомобильной жизни, включая новинки, инновации и события.

articlerockstars.com

Мы следим за всеми тенденциями, чтобы предоставить вам максимально точную информацию.

Если вы интересуетесь автомобилями, этот сайт станет вашим лучшим другом. -

Benitovet

На данной платформе вы найдете клинику ментального здоровья, которая обеспечивает поддержку для людей, страдающих от стресса и других психических расстройств. Наша эффективные методы для восстановления ментального здоровья. Врачи нашего центра готовы помочь вам преодолеть трудности и вернуться к психологическому благополучию. Опыт наших специалистов подтверждена множеством положительных обратной связи. Запишитесь с нами уже сегодня, чтобы начать путь к лучшей жизни.

http://hillbilliesandheroes.net/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fl%2Flamotridzhin%2F -

vorbelutrioperbir

I am glad to be a visitor of this everlasting blog! , regards for this rare information! .

-

gameathlon.gr-Rit

Stake Online Casino gameathlon.gr is among the best cryptocurrency casinos since it integrated crypto into its transactions early on.

The digital casino industry has expanded significantly and the choices for players are abundant, not all online casinos offer the same experience.

This article, we will take a look at top-rated casinos available in the Greek region and what benefits they provide who live in the Greek region.

Best online casinos of 2023 are shown in the table below. You will find the best casino websites as rated by our expert team.

For every casino, it is important to check the legal certification, gaming software licenses, and security protocols to guarantee safe transactions for users on their websites.

If any of these factors are absent, or if we can’t confirm any of these elements, we avoid that platform.

Gaming providers also play a major role in determining an gaming platform. As a rule, if there’s no valid license, you won’t find reliable providers like Microgaming represented on the site.

Reputable casinos offer classic payment methods like Mastercard, but should also provide e-wallets like Neteller and many others. -

Benitovet

На этом ресурсе вы найдете учреждение психологического здоровья, которая обеспечивает психологические услуги для людей, страдающих от депрессии и других психологических расстройств. Наша эффективные методы для восстановления ментального здоровья. Врачи нашего центра готовы помочь вам преодолеть проблемы и вернуться к сбалансированной жизни. Профессионализм наших врачей подтверждена множеством положительных рекомендаций. Свяжитесь с нами уже сегодня, чтобы начать путь к лучшей жизни.

http://jendocore.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fo%2Folanzapin%2F -

zoritoler imol

Today, while I was at work, my cousin stole my iphone and tested to see if it can survive a forty foot drop, just so she can be a youtube sensation. My apple ipad is now broken and she has 83 views. I know this is completely off topic but I had to share it with someone!

-

Benitovet

Здесь вы найдете клинику ментального здоровья, которая предоставляет психологические услуги для людей, страдающих от тревоги и других психических расстройств. Эта эффективные методы для восстановления психического здоровья. Наши опытные психологи готовы помочь вам справиться с психологические барьеры и вернуться к гармонии. Квалификация наших специалистов подтверждена множеством положительных обратной связи. Обратитесь с нами уже сегодня, чтобы начать путь к оздоровлению.

http://lidiasilva.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Fpreparations%2Fl%2Flamotridzhin%2F -

Benitovet

Здесь вы найдете клинику ментального здоровья, которая предоставляет профессиональную помощь для людей, страдающих от депрессии и других психических расстройств. Мы предлагаем комплексное лечение для восстановления ментального здоровья. Врачи нашего центра готовы помочь вам преодолеть трудности и вернуться к сбалансированной жизни. Квалификация наших врачей подтверждена множеством положительных обратной связи. Запишитесь с нами уже сегодня, чтобы начать путь к восстановлению.

http://lipscombautodirect.com/__media__/js/netsoltrademark.php?d=empathycenter.ru%2Farticles%2Fgemofobiya-boyazn-vida-krovi%2F -

hire private jet-Adops

VectorJet specializes in organizing exclusive aviation services, group flights, and logistics charters.

They offer bespoke solutions for private jet journeys, quick air transfers, rotorcraft services, and cargo transport, including time-critical and relief missions.

The company provides adaptive travel options with personalized jet selections, round-the-clock support, and help with special requests, such as animal-friendly travel or off-grid destination access.

Complementary services include jet leasing, sales, and business aviation management.

VectorJet acts as an agent between customers and service providers, ensuring premium quality, convenience, and efficiency.

Their mission is to make private aviation accessible, secure, and fully customized for each client.

private jet booking -

gameathlon.gr-Rit

Stake Casino gameathlon.gr is one of the leading crypto gambling as it was one of the pioneers.

The online casino market is growing rapidly and there are many options, but not all casinos provide the same quality of service.

In this article, we will review the best casinos available in the Greek market and the benefits they offer who live in Greece.

The top-rated casinos of 2023 are shown in the table below. Here are the highest-rated casinos as rated by our expert team.

When choosing a casino, it is essential to verify the validity of its license, gaming software licenses, and data protection measures to confirm security for users on their websites.

If any of these factors are absent, or if we can’t confirm any of these elements, we avoid that platform.

Software providers are another important factor in selecting an internet casino. Generally, if the above-mentioned licensing is missing, you won’t find trustworthy software developers like NetEnt represented on the site.

Top-rated online casinos offer known payment methods like Mastercard, but should also provide e-wallets like PayPal and many others. -

грузоперевозки Минск-Mar

Транспортировка грузов в столице — надежное решение для компаний и частных лиц.

Мы предлагаем перевозки в пределах Минска и окрестностей, функционируя каждый день.

В нашем транспортном парке технически исправные грузовые машины разной грузоподъемности, что помогает адаптироваться под любые потребности клиентов.

gruzoperevozki-minsk12.ru

Мы содействуем квартирные переезды, транспортировку мебели, строительных материалов, а также малогабаритных товаров.

Наши сотрудники — это профессиональные работники, знающие улицах Минска.

Мы гарантируем своевременную подачу транспорта, осторожную погрузку и разгрузку в указанное место.

Подать заявку на грузоперевозку легко через сайт или по телефону с быстрым ответом. -

gameathlon.gr-Rit

Stake Casino gameathlon.gr is considered one of the top cryptocurrency casinos as it was one of the pioneers.

Online gambling platforms has expanded significantly and there are many options, but not all casinos offer the same experience.

In this article, we will review the most reputable casinos you can find in Greece and the benefits they offer who live in the Greek region.

The top-rated casinos of 2023 are shown in the table below. The following are the top-ranking gambling platforms as rated by our expert team.

For any online casino, it is essential to verify the validity of its license, security certificates, and data protection measures to guarantee safe transactions for users on their websites.

If any important details are missing, or if we can’t confirm any of these elements, we do not return to that site.

Gaming providers are crucial in selecting an internet casino. Generally, if the previous factor is missing, you won’t find reliable providers like Evolution represented on the site.

Reputable casinos offer both traditional payment methods like Visa, and they should also offer e-wallets like Neteller and many others. -

gameathlon.gr-Rit

Stake Casino gameathlon.gr is among the best crypto gambling since it integrated crypto into its transactions early on.

The online casino market is evolving and the choices for players are abundant, however, not all of them are created equal.

In this article, we will review the most reputable casinos accessible in Greece and the advantages for players who live in Greece.

Best online casinos of 2023 are shown in the table below. The following are the highest-rated casinos as rated by our expert team.

When choosing a casino, it is essential to verify the legal certification, security certificates, and data protection measures to confirm security for all users on their websites.

If any important details are missing, or if it’s hard to verify them, we exclude that website from our list.

Software providers are crucial in selecting an gaming platform. Typically, if there’s no valid license, you won’t find reliable providers like Play’n Go represented on the site.

Reputable casinos offer classic payment methods like Visa, but should also provide electronic payment methods like Skrill and many others. -

gruzoperevozki-minsk12.ru-Mar

Транспортировка грузов в городе Минск — надежное решение для компаний и физических лиц.

Мы предлагаем доставку в пределах Минска и окрестностей, работая ежедневно.

В нашем автопарке современные транспортные средства разной грузоподъемности, что позволяет учитывать любые запросы клиентов.

gruzoperevozki-minsk12.ru

Мы помогаем офисные переезды, транспортировку мебели, строительных материалов, а также небольших грузов.

Наши водители — это квалифицированные эксперты, отлично ориентирующиеся в дорогах Минска.

Мы обеспечиваем своевременную подачу транспорта, аккуратную погрузку и разгрузку в нужное место.

Оформить грузоперевозку можно через сайт или по контактному номеру с помощью оператора. -

www.gameathlon.gr-wex

The GameAthlon platform is a popular online casino offering thrilling games for players of all backgrounds.

The platform offers a diverse collection of slot games, real-time games, card games, and betting options.

Players can enjoy fast navigation, high-quality graphics, and easy-to-use interfaces on both desktop and mobile devices.

gameathlon online casino

GameAthlon prioritizes safe gaming by offering secure payments and fair outcomes.

Reward programs and loyalty programs are regularly updated, giving registered users extra opportunities to win and enjoy the game.

The support service is on hand day and night, assisting with any inquiries quickly and professionally.

This platform is the top destination for those looking for an adrenaline rush and exciting rewards in one reputable space. -

gruzoperevozki-minsk12.ru-Mar

Транспортировка грузов в столице — выгодное решение для бизнеса и домашних нужд.

Мы оказываем транспортировку в пределах Минска и области, предоставляя услуги каждый день.

В нашем парке автомобилей новые транспортные средства разной грузоподъемности, что помогает учесть любые задачи клиентов.

gruzoperevozki-minsk12.ru

Мы обеспечиваем квартирные переезды, доставку мебели, строительных материалов, а также компактных посылок.

Наши сотрудники — это квалифицированные эксперты, отлично ориентирующиеся в маршрутах Минска.

Мы гарантируем оперативную подачу транспорта, бережную погрузку и разгрузку в нужное место.

Оформить грузоперевозку вы можете онлайн или по звонку с консультацией. -

TestUser

cNDCe dvemH fYCR gBBxPmT BvgpgeZ

-

www.gameathlon.gr-wex

GameAthlon is a popular gaming site offering dynamic gameplay for gamblers of all levels.

The site features a extensive collection of slot games, live dealer games, classic casino games, and betting options.

Players can enjoy fast navigation, top-notch visuals, and user-friendly interfaces on both computer and smartphones.

http://www.gameathlon.gr

GameAthlon takes care of security by offering secure payments and fair RNG systems.

Reward programs and VIP perks are regularly updated, giving members extra incentives to win and enjoy the game.

The customer support team is ready around the clock, supporting with any questions quickly and professionally.

GameAthlon is the perfect place for those looking for entertainment and huge prizes in one safe space. -

Междугородние перевозки автобусом

Оказываем прокат автобусов и микроавтобусов с водителем крупным компаниям, бизнеса любого масштаба, а также физическим лицам.

https://avtoaibolit-76.ru/

Мы обеспечиваем удобную и надежную поездку небольших и больших групп, организуя перевозки на торжества, корпоративные праздники, туристические поездки и разные мероприятия в Челябинске и Челябинской области. -

Прокат автобусов с кондиционером

Мы предлагаем аренду автобусов и микроавтобусов с водителем крупным компаниям, малого и среднего бизнеса, а также частным лицам.

https://avtoaibolit-76.ru/

Организуем удобную и надежную транспортировку для коллективов, организуя перевозки на свадебные мероприятия, корпоративные встречи, экскурсии и все типы мероприятий в регионе Челябинска. -

Пассажирские перевозки в Челябинске

Оказываем услуги проката автобусов и микроавтобусов с водителем корпоративным клиентам, бизнеса любого масштаба, а также для частных клиентов.

Автобус на выпускной

Обеспечиваем максимально комфортную и надежную поездку пассажиров, организуя заказы на свадебные мероприятия, корпоративы, групповые экскурсии и другие мероприятия в городе Челябинске и Челябинской области. -

Jordanlaf

Exquisite wristwatches have long been synonymous with precision. Crafted by legendary brands, they combine classic techniques with modern technology.

All elements demonstrate unmatched quality, from hand-assembled movements to premium materials.

Wearing a horological masterpiece is more than a way to check the hour. It signifies sophisticated style and heritage craftsmanship.

Whether you prefer a minimalist aesthetic, Swiss watches offer remarkable beauty that never goes out of style.

https://vikefans.com/forums/showthread.php?tid=20480 -

сертификация качества продукции

Сертификация в нашей стране остается неотъемлемым процессом выхода продукции на рынок.

Система сертификации подтверждает соответствие установленным требованиям государственным стандартам и законам, что гарантирует защиту покупателей от небезопасной продукции.

сертификация продукции

К тому же, официальное подтверждение качества облегчает деловые отношения с заказчиками и расширяет перспективы в предпринимательской деятельности.

При отсутствии сертификатов, возможны штрафы и ограничения в процессе реализации продукции.

Вот почему, оформление документации не просто формальностью, но и важным фактором устойчивого роста компании в сфере торговли. -

JasonDrype

You can find a vast selection of certified pharmaceutical products for various needs.

Our online pharmacy guarantees quick and safe shipping right to your door.

All products is sourced from trusted pharmaceutical companies to ensure safety and quality.

You can browse our online store and get your medicines in minutes.

Need help? Our support team are here to help whenever you need.

Prioritize your well-being with affordable medical store!

https://www.apsense.com/article/838493-buy-fildena-100-mg-finding-the-best-deals-online.html -

bs2best at сайт

Даркнет — это скрытая область сети, куда открывается доступ исключительно через защищенные браузеры, такие как I2P.

Здесь размещаются законные , например, обменные сервисы и различные площадки.

Одной из известных онлайн-площадок считается BlackSprut, данный ресурс занималась реализации разнообразной продукции.

bs2best

Эти сайты нередко функционируют на биткойны в целях анонимности транзакций. -

оформление сертификатов

Сертификация в нашей стране по-прежнему считается ключевым этапом легальной реализации товаров.

Этот процесс подтверждает соответствие нормам и правилам, а это защищает покупателей от некачественных товаров.

сертификация

Кроме того, сертификация помогает взаимодействие с партнерами и повышает возможности на рынке.

Без сертификации, может возникнуть юридические риски и барьеры при продаже товаров.

Таким образом, официальное подтверждение качества является не просто обязательным, но и важным фактором устойчивого роста бизнеса в России. -

bs2best.gdn

Даркнет — это анонимная часть интернета, куда можно попасть с использованием защищенные браузеры, например, через Tor.

В этой среде доступны легальные , например, обменные сервисы и прочие площадки.

Одной из крупнейших платформ была Black Sprut, которая занималась продаже разных категорий.

bs2best актуальная ссылка

Такие ресурсы часто используют биткойны для повышения анонимности транзакций. -

🖋 + 1.919277 BTC.NEXT - https://graph.org/Message--04804-03-25?hs=8a6d37f3c178e40c297b2bbefa53d30b& 🖋

dftoct

-

JulioLef

Purchasing drugs online has become way easier than shopping in person.

There’s no reason to deal with crowds or worry about limited availability.

Online pharmacies give you the option to buy prescription drugs with just a few clicks.

Many websites offer discounts unlike brick-and-mortar pharmacies.

https://queenkaymusic.com/forums/topic/%d0%bd%d0%b8%d0%ba%d1%82%d0%be%d1%84%d0%be%d0%b1%d0%b8%d1%8f/page/24/#post-204417

On top of that, it’s easy to browse various options quickly.

Reliable shipping means you get what you need fast.

What do you think about purchasing drugs from the internet? -

bs2best at

BlackSprut – платформа с особыми возможностями

BlackSprut привлекает обсуждения широкой аудитории. Почему о нем говорят?

Данный ресурс обеспечивает интересные опции для своих пользователей. Оформление платформы характеризуется функциональностью, что делает платформу понятной даже для тех, кто впервые сталкивается с подобными сервисами.

Стоит учитывать, что этот ресурс работает по своим принципам, которые делают его особенным в своей нише.

При рассмотрении BlackSprut важно учитывать, что различные сообщества выражают неоднозначные взгляды. Одни подчеркивают его возможности, другие же оценивают его более критично.

В целом, данный сервис остается темой дискуссий и вызывает заинтересованность разных пользователей.

Обновленный домен BlackSprut – ищите здесь

Хотите найти актуальное зеркало на BlackSprut? Это можно сделать здесь.

bs2best at

Периодически ресурс меняет адрес, и тогда приходится искать актуальное зеркало.

Свежий доступ всегда можно найти здесь.

Проверьте актуальную версию сайта прямо сейчас! -

Travisglina

Мы предлагает помощью иностранных граждан в Санкт-Петербурге.

Оказываем содействие в получении необходимых бумаг, регистрации, и вопросах, для официального трудоустройства.

Наша команда разъясняют по вопросам законодательства и дают советы лучшие решения.

Оказываем поддержку в оформлении ВНЖ, а также по получению гражданства.

С нами, процесс адаптации станет проще, решить все юридические формальности и комфортно устроиться в этом прекрасном городе.

Обращайтесь, и мы подробно расскажем обо всех возможностях!

https://spb-migrant.ru/ -

b2best.at

Почему BlackSprut привлекает внимание?

BlackSprut привлекает обсуждения разных сообществ. Но что это такое?

Этот проект предлагает широкие опции для своих пользователей. Интерфейс системы отличается простотой, что делает его интуитивно удобной даже для новичков.

Стоит учитывать, что BlackSprut обладает уникальными характеристиками, которые формируют его имидж в своей нише.

Говоря о BlackSprut, стоит отметить, что различные сообщества имеют разные мнения о нем. Многие подчеркивают его функциональность, другие же оценивают его неоднозначно.

Подводя итоги, эта платформа продолжает быть предметом обсуждений и вызывает заинтересованность широкой аудитории.

Свежий сайт BlackSprut – ищите здесь

Если нужен обновленный сайт BlackSprut, то вы по адресу.

bs2best актуальная ссылка

Сайт часто обновляет адреса, поэтому важно иметь обновленный линк.

Мы следим за актуальными доменами и готовы поделиться новым линком.

Посмотрите актуальную ссылку прямо сейчас! -

JulioLef

Ordering medicine on the internet can be far easier than visiting a local drugstore.

No need to wait in line or worry about store hours.

Online pharmacies let you buy prescription drugs without leaving your house.

A lot of websites offer discounts unlike traditional drugstores.

https://forum.danube.com.bd/index.php/topic,98937.new.html#new

Plus, it’s possible to compare different brands easily.

Quick delivery adds to the ease.

Have you tried purchasing drugs from the internet? -

JulioLef

Ordering medicine on the internet can be much more convenient than going to a physical pharmacy.

You don’t have to stand in queues or think about store hours.

E-pharmacies allow you to buy your medications from home.

A lot of websites have special deals in contrast to physical stores.

https://forum.mban.com.np/showthread.php?tid=7&pid=516#pid516

On top of that, it’s easy to browse alternative medications quickly.

Fast shipping makes it even more convenient.

Do you prefer buying medicine online? -

Roberthal

На данном ресурсе доступны свежие международные политические новости. Ежедневные публикации дают возможность быть в курсе главных новостей. Здесь освещаются дипломатических переговорах. Объективная аналитика помогают глубже понять ситуацию. Будьте в центре событий вместе с нами.

https://justdoitnow03042025.com -

чемпион слоты

Фанаты слотов могут легко получить доступ к актуальное зеркало игровой платформы Champion и наслаждаться популярными автоматами.

На платформе представлены разнообразные игровые автоматы, включая классические, и самые свежие игры от ведущих производителей.

Когда основной портал не работает, зеркало казино Чемпион поможет без проблем войти и делать ставки без перебоев.

чемпион слот

Весь функционал сохраняются, включая регистрацию, финансовые операции, а также бонусы.

Пользуйтесь актуальную ссылку, и не терять доступ к казино Чемпион! -

bs2best

Почему BlackSprut привлекает внимание?

Сервис BlackSprut привлекает интерес широкой аудитории. Почему о нем говорят?

Эта площадка предлагает разнообразные опции для аудитории. Визуальная составляющая платформы отличается удобством, что делает его доступной даже для тех, кто впервые сталкивается с подобными сервисами.

Стоит учитывать, что этот ресурс работает по своим принципам, которые делают его особенным на рынке.

Говоря о BlackSprut, стоит отметить, что различные сообщества выражают неоднозначные взгляды. Одни отмечают его удобство, а некоторые относятся к нему с осторожностью.

Подводя итоги, эта платформа продолжает быть предметом обсуждений и удерживает внимание широкой аудитории.

Рабочее зеркало к БлэкСпрут – узнайте здесь

Если ищете обновленный домен BlackSprut, то вы по адресу.

https://bs2best

Сайт часто обновляет адреса, поэтому важно знать обновленный линк.

Обновленный доступ всегда можно узнать у нас.

Посмотрите актуальную версию сайта прямо сейчас! -

John

PknTh NLrEg TLuxPrHf nFiA PloLJQss

-

PatrickTub

This website features a large variety of video slots, suitable for both beginners and experienced users.

Here, you can discover retro-style games, new generation slots, and huge-win machines with amazing animations and realistic audio.

If you are looking for easy fun or love bonus-rich rounds, you’re sure to find what you’re looking for.

http://kruglistol.zbord.ru/viewtopic.php?p=117340#117340

All games is playable around the clock, right in your browser, and fully optimized for both all devices.

Besides slots, the site provides tips and tricks, welcome packages, and user ratings to enhance your experience.

Sign up, start playing, and get immersed in the thrill of online slots! -

актуальное зеркало 1xbet

На нашем портале вам предоставляется возможность наслаждаться большим выбором игровых автоматов.

Игровые автоматы характеризуются живой визуализацией и интерактивным игровым процессом.

Каждый слот предлагает особые бонусные возможности, улучшающие шансы на успех.

1 x bet зеркало

Слоты созданы для игроков всех уровней.

Есть возможность воспользоваться демо-режимом, после чего начать играть на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов. -

top podcasts

Hearing health is important for communication and quality of life. Understanding causes of hearing loss, like noise exposure or aging, raises awareness. Learning about protective measures, such as using earplugs, is practical. Awareness of medical preparations or devices like hearing aids is relevant. Knowing when to get hearing tests helps address issues early. Finding reliable information on preserving hearing is valuable. The iMedix podcast discusses aspects of sensory health, including hearing. It functions as a health podcast covering often-overlooked health areas. Explore the iMedix health podcast for hearing protection insights. iMedix: Your Personal Health Advisor for all senses.

-

iMedix.com

Understanding respiratory health is essential, especially with concerns like air quality. Learning how the lungs work and common respiratory conditions is basic knowledge. Knowing about asthma, COPD, and allergies enables better management. Familiarity with medical preparations like inhalers or nebulizers is key. Understanding triggers and avoidance strategies improves daily life. Finding reliable information on protecting lung health is important. The iMedix podcast covers conditions affecting major organ systems, including respiratory. As an online health information podcast, it’s easily accessible. Explore the iMedix online health podcast for respiratory wellness tips. iMedix provides trusted health advice on breathing easier.

-

how to commit suicide without pain

Taking one’s own life is a serious phenomenon that touches millions of people across the world.